CIBIL Score

If you're planning to take out a loan or apply for a credit card in India, a good CIBIL score is essential. A high score can get you smooth approval and favourable interest rates. But what exactly is CIBIL and why does it matter?

The Credit Information Bureau (India) Limited, commonly known as CIBIL, is a leading credit information company in India. Licensed by the Reserve Bank of India (RBI), it generates credit scores that indicate your creditworthiness.

For those applying for a loan or credit card, understanding the importance of this score is crucial. This guide will help you navigate the essentials of CIBIL and its impact on your financial opportunities. We will also understand how to make a CIBIL score check before applying for any credit product.

What is CIBIL Score?

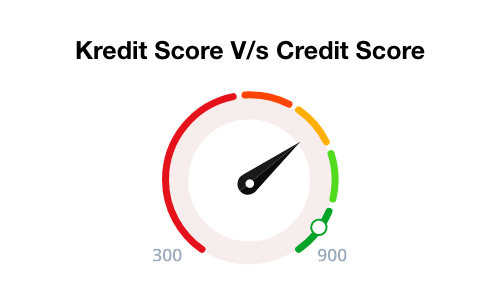

The CIBIL score is a 3-digit number ranging from 300 to 900 that summarises your credit history and financial behaviour. A score closer to 900 indicates a stronger credit rating, which is crucial for lenders when assessing loan applications.

While factors such as income, occupation, and age play a role in lending decisions, your CIBIL rating is often among the most significant requirements. Even if you meet all other eligibility requirements, a poor score can lead to rejection.

Important: The CIBIL score is not the same as the aecb credit score. We will discuss their differences in more detail later.

CIBIL Score Range & How it Works

While there’s no specific categorisation of these scores, here's a breakdown of what different score ranges generally signify —

- 300-549: This is the lowest CIBIL range, indicating poor credit behaviour. It suggests that you have frequently delayed credit card bill payments or loan EMIs, placing you at a high risk of defaulting on future loans and credit.

- 550-649: This range is considered fair but still shows signs of financial struggle. While you may not have a history of severe defaults, consistent delays in payments can hinder your chances of obtaining credit.

- 650-749: A score in this range reflects good credit behaviour. You have a good chance of getting approved for loans and credit cards. However, you might still not qualify for the best interest rates available.

- 750-900: Scores above 750 are deemed excellent, demonstrating that you consistently meet your payment obligations and pose the least risk of default. With such a strong credit history, lenders are more likely to approve your loans and credit card applications at lower interest rates.

How is Your CIBIL Score Calculated?

CIBIL calculates your score based on various factors, including —

- Payment History (35%): The most important factor, it reflects your timeliness in making payments. A strong record of on-time payments boosts your score, while missed or late payments can lower it.

- Amount Owed (30%): This considers your total outstanding debt. High balances or maxed-out credit cards can negatively impact your score while keeping balances low helps improve it.

- Length of Credit History (15%): A higher score and consistent record of on-time payments is often the result of a longer credit history. To build your history, it’s essential to use credit products for a prolonged time.

- Mix of Credit (10%): Having a variety of credit types — such as credit cards, loans, and mortgages — can enhance your score. It demonstrates your ability to manage different forms of credit.

- Credit Activity (10%): This includes your recent credit behaviour such as new account applications and credit usage. Responsible management of your accounts can positively affect this part of your score.

Benefits of a High Credit Score

Having a good CIBIL score, typically 700 or above, comes with several advantages that can significantly enhance your financial opportunities.

Here are some major points —

- Faster Loan Processing: A high score ensures quicker approval for loans and credit cards.

- Easy Renting: Landlords frequently look at credit scores to determine whether a tenant can pay rent on time, so having a high score can help you secure a chosen rental home.

- Attractive Credit Card Offers: Healthy CIBIL scores open doors to credit cards with appealing rewards and benefits.

- Higher Credit Limits: Good credit management can often lead to higher credit limits. This can boost your purchasing power.

What Does Your CIBIL Report Include?

Your credit report is a comprehensive document that provides a complete overview of your credit history. Familiarising yourself with your report allows you to identify any areas for improvement.

It contains essential information, including —

- Your name, address, and contact details

- Dates when you opened each credit account

- A record of your job history

- Current balances on your accounts

- Your credit card limits

Many different parties may access your credit report, such as —

- Creditors: Companies that extend credit or loans

- Landlords: Property owners who may review your credit history during rental applications

- Lenders: Banks and non-banking financial institutions (NBFCs) that assess your creditworthiness

Important Terms in CIBIL Range Report

Given the detailed nature of the CIBIL score report, it’s important to understand how to read and interpret it.

Here are the key terms —

- Asset Classification: This refers to how lenders categorise your assets based on the latter’s quality and the risk of default. Common classifications include standard, substandard, doubtful, and loss assets.

- Cash Limit: The maximum amount of cash that can be withdrawn or accessed on a credit card. This limit can impact your overall credit utilisation ratio.

- CN (Control Number): A unique report number assigned to your credit account or transaction. It is used for tracking and reference purposes (as well as disputes).

- Collateral: This refers to the asset(s) pledged by you to secure a loan. If you make any default, the lender can claim the collateral to recover the outstanding amount.

- DPD (Days Past Due): The number of days a payment is overdue. It helps lenders assess your payment behaviour and credit risk.

If you see ‘XXX’ that means the information has not been reported to CIBIL by the bank yet.

- High Credit: The highest amount ever borrowed or the maximum credit limit on an account. This figure helps lenders understand your credit usage.

- Sanctioned Amount: The total amount of credit or loan approved by the lender to you. It reflects the lender's assessment of your creditworthiness.

- Settlement Amount: The amount agreed upon between you and the lender to resolve a debt — typically less than the outstanding balance — usually after negotiation.

- Wilful Default: A situation where the lender files a case against you.

How Does CIBIL Score Affect Your Loan and Credit Card Eligibility?

When you apply for a loan or credit card, the lender reviews your CIBIL range as part of the evaluation process.

Here’s how this affects you —

- Impact of Score: A poor CIBIL score can lead to the rejection of your application. In contrast, a high score facilitates easier approvals for loans and credit cards.

- Not the Only Factor: While your CIBIL range is significant, it’s not the sole determinant of your credit capacity.

Lenders also consider additional factors, including —- Debt-Income Ratio: This measures your debt relative to your income, helping lenders assess your ability to repay

- Employment History: A stable employment record can enhance your application’s attractiveness

- Profession and Other Details: Your job type and other relevant information can also influence the lender's decision

Tips to Improve Your CIBIL Score

By following these strategies, you can gradually improve your CIBIL range and open the door to better loan terms and faster approvals —

- Pay Dues on Time: Set reminders and automate bill payments to ensure you never miss an EMI or credit card due date. Timely payments have a significant positive impact on your score.

- Use Credit Wisely: Avoid taking on excessive debt at once. Limit the number of loans you apply for within a short period. Similarly, don’t use too much of your credit limit at once.

- Maintain a Healthy Credit Mix: A balanced combination of secured (like home and auto loans) and unsecured loans (like personal loans and credit cards) is beneficial.

- Apply for Credit Responsibly: Only apply for new credit when necessary and ensure you can repay it. Frequent applications can signal financial instability, negatively affecting your score.

- Monitor Joint Accounts: Keep an eye on co-signed, guaranteed, and joint accounts and cards. You’re equally responsible for missed payments, which can impact your creditworthiness.

- Review Your Credit History Regularly: Frequently check your credit report for inaccuracies. Errors can occur — timely corrections can prevent negative impacts on your score.

- Build Credit Gradually: Use debt wisely. Consider longer loan tenures for lower EMIs and increase your credit limit without overspending. Also, keep using old credit cards occasionally to increase your credit history’s age over time.

| Looking for ways to improve your credit score? Read our detailed article on Ways to fix bad scores in the UAE. Difference Between AECB Score and CIBIL Score |

The AECB (al etihad credit bureau) score and the CIBIL (Credit Information Bureau India Limited) score are both credit scores used to evaluate your creditworthiness. However, these scores are not the same — they serve different regions and have distinct characteristics.

Here are the key differences —

| Feature | AECB Score | CIBIL Score |

|---|---|---|

| Founding Year of the Issuing Entity | 2012 | 2000 |

| Geographic Focus | Only used in the UAE to assess creditworthiness | One of the 4 licenced credit bureaus in India Others include —

|

| Ownership Entity | A Public Joint Stock Company owned by UAE Federal Government | A Private Limited Company owned by TransUnion, an American multinational group |

| Score Range | Ranges from 300 to 900 — higher scores indicate better creditworthiness | Also ranges from 300 to 900, following a similar scoring system |

| Regulatory Authority | Operates under the regulations of the UAE government | Licensed by the Reserve Bank of India, adhering to Indian regulations |

How to Check Your Credit Score Online?

As mentioned earlier, CIBIL and AECB scores are two different scores. We will look at the process of checking these scores individually —

CIBIL Score Check

Follow the below steps to check your CIBIL score for free —

- CIBIL Official Website

You can directly visit the official site of CIBIL to access your score and credit report directly. Keep in mind that you may have to register yourself first.

- Banking Apps

Many banks and financial institutions offer free access to your CIBIL range through their mobile apps or websites, especially if you're a customer.

- Mobile Apps

You can check your CIBIL score on UPI apps like Google Pay and more. Apps like CRED also allow users to check their credit scores easily, along with providing tips on improving credit health.

AECB Score Check

On Paisabazaar.ae, you can easily check your credit score in UAE for free!

Here are the steps —

- On Paisabazaar.ae, go to ‘AECB Credit Score’ under the ‘Banking Product’ dropdown

- Add your details and click on ‘Check Credit Score’

- Follow the steps to view your score

Click here to check your AECB credit score!

Frequently Asked Questions

Ans: There is no limit on CIBIL score checks if you do it yourself. While most sites recommend checking your score at least once a year, you can also do it once every month.

Ans: To achieve a 750 CIBIL score, pay your bills on time, maintain a credit utilisation ratio below 30%, have a healthy mix of secured and unsecured loans, limit loan applications, regularly check your credit report for errors, and build a long credit history.

Ans: A CIBIL score of 0 typically means that you don't have any credit history. This can happen if you've never taken out a loan, used a credit card, or had any other credit accounts.

Ans: A higher score increases your chances of loan approval. It also allows for better interest rates and higher credit limits.

Ans: Your CIBIL report includes personal information, account details, and your credit score. Key sections to focus on include your payment history, credit accounts, and any inquiries made by lenders.

| Credit Score for different types of Loan | |||

|---|---|---|---|

| Credit Score for Personal Loan | Credit Score for House Loan | Credit Score for Car Loan | Credit Score for Student Loan |

More From Credit Score

- Recent Articles

- Popular Articles